Don’t be gloomy about Tesla and its EV rivals

The industry has had a terrible few months. But demand is likely to pick up

Apr 24th 2024

One reason for optimism is that the recent slowdown is partly cyclical. Sales grew rapidly in 2021 and 2022 as cash-rich consumers went on a post-pandemic spending spree. Many evs that are not being bought now were purchased back then.

Higher interest rates mean that Americans who paid less than 5% a year on a car loan two years ago now have to pay more than 8%. That is a problem.

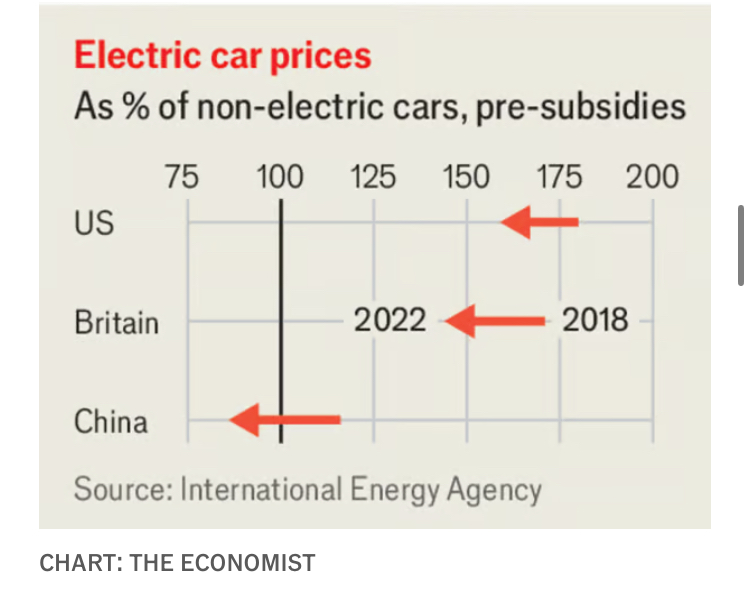

The green premium is narrowing for many models. Prices of battery minerals such as lithium have fallen, as have prices of the cells they go into.

Today you can buy a Ford f-150 Lightning for less than $40,000, just $4,000 more than the petrol version of the popular pickup—$4,000 that you earn back in a single year by not having to fill it up with petrol (which, in contrast to lithium, is not getting cheaper). It is easier to juice up, too, at one of roughly 200,000 charging ports across America, twice the number available in 2020.

Western carmakers may also draw lessons from the Chinese experience. Whereas early adopters bought a Tesla as a status symbol, the Chinese are now buying cars made by its rival, byd.

Western makers should fixate less on high-end models and stop neglecting the middle-of-the-road. Until they do, high prices will keep demand subdued and economies of scale elusive.

The fact that investors are becoming more discerning should help. They are no longer prepared to pour billions into any e-startup. And they are rewarding firms with mass-market ambitions.

Western governments worried about climate change and oil prices could do more to speed along the ev revolution, by giving Chinese carmakers more access to their markets.

AlixPartners found that seven in ten Americans, Britons, French and Germans would consider an ev from China if it cost 20% less than a non-Chinese alternative—which is close to the real price difference.