America’s rental-market mystery

Mar 7th 2024

And why it may deter the Federal Reserve from cutting interest rates

At issue is the manner in which housing fits into the consumer-price index.

To the surprise of many casual observers, statisticians typically do not include property prices in their inflation gauges since they view housing as an investment good.

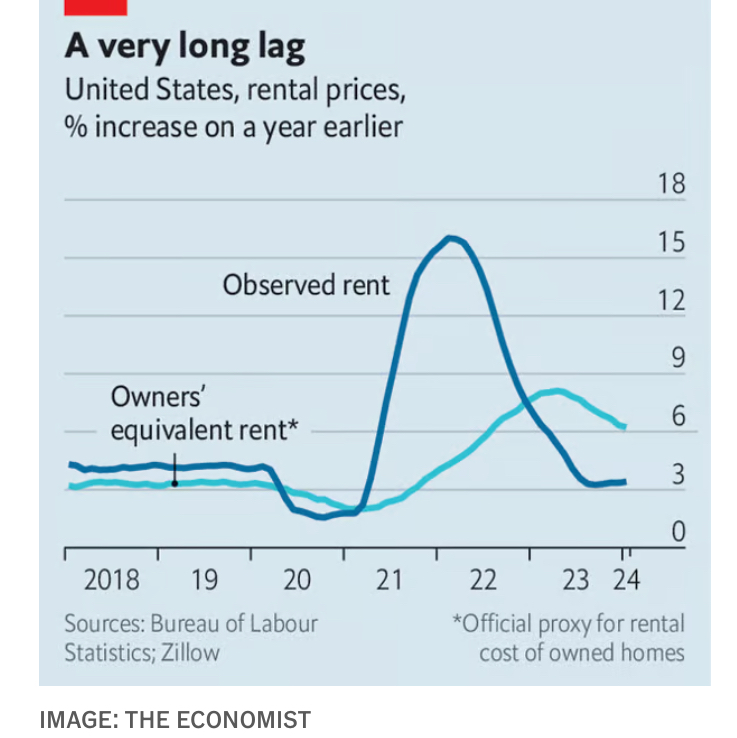

the inflation indices factor in how much people pay for rent—or would pay for rent if they leased their own homes. The latter is known as owners’ equivalent rent (oer).

In America oer accounts for about a quarter of the consumer-price index, making it the single biggest component. Direct rent, by contrast, is just 8% of the index, because renting is less common: about two-thirds of American households own the homes they live in.

wonks assign a heavier weight to rental prices for single-family homes, which are similar to the kinds of houses that people own. The problem is that there is a relative dearth of single-family homes for rent, giving statisticians a small sample with which to work.

In January the consumer-price index rose by 0.3% from a month earlier, above forecasts for a 0.2% increase. But nearly half of the broader inflation increase was attributable to a rise in oer alone. And strikingly, the rise in oer was much higher than the rise in market rents.

The question is whether oer is being estimated correctly. It is true that single-family homes have commanded larger rent increases than flats recently, a reflection of the fact that few such homes are available to tenants.

The combination of higher rents plus a larger weighting does explain much of the rise in oer. Added to that, though, is the inevitable volatility of extracting prices from the small sample of single-family homes for rent. This raises the possibility that at least some of the high oer reading was a fluke.

Continued tightness in the market for single-family homes ensures the divergence will probably continue for some time, and this in turn will place upward pressure on general measures of inflation.