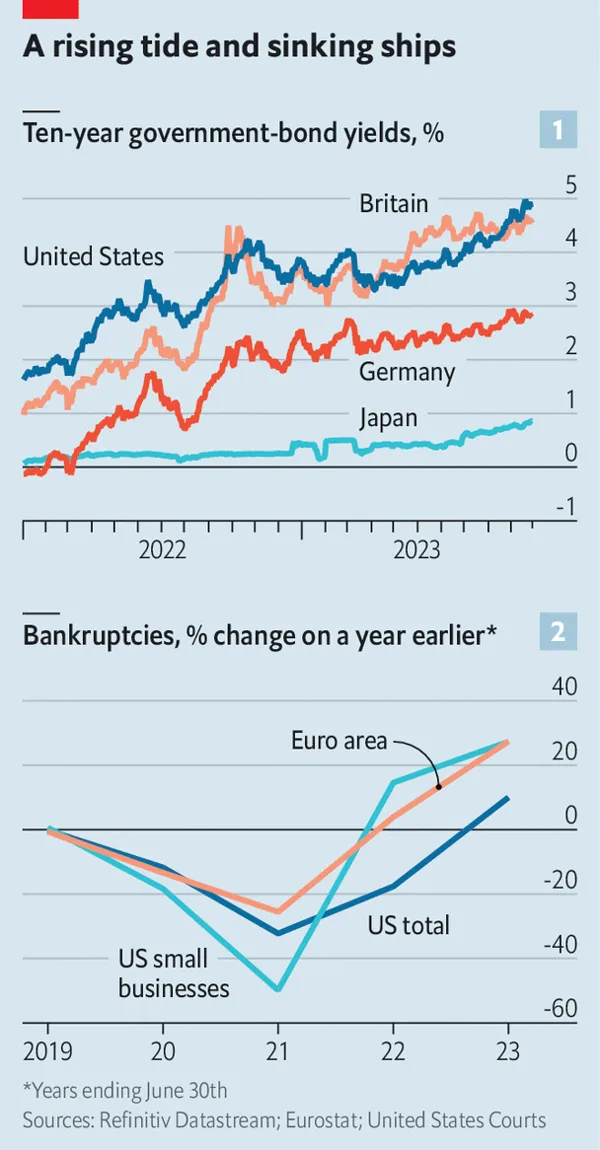

Markets think interest rates could stay high for a decade or more

nov. 2nd. 2023.

The conviction that rates will remain “higher for longer” is spreading around the world.

Can the world economy cope with corporate deleveraging, falling house prices, turmoil at banks and fiscal frugality? Surprisingly, the answer is, perhaps—if rates have risen for the right reason.

For rates to have shifted permanently, that outlook must have changed. One possible reason it might have is the anticipation of faster economic growth, driven, perhaps, by recent advances in artificial intelligence (ai). In the long term, growth and interest rates are intimately linked.

It might seem farfetched to say that optimism about ai is pushing up bond yields. Yet it would explain why the prospect of higher-for-longer has not caused stockmarkets to fall much.

In fact, as optimism about ai has spread, the value of big tech firms such as Microsoft and Nvidia has soared.

To the extent that productivity growth explains higher rates, the new era could be a happy one. Alongside the rise in debt-service costs, households will have higher real incomes, firms will have higher revenues, financial institutions will enjoy low default rates and governments will collect more tax. Healthy competition for capital might even bring benefits of its own.

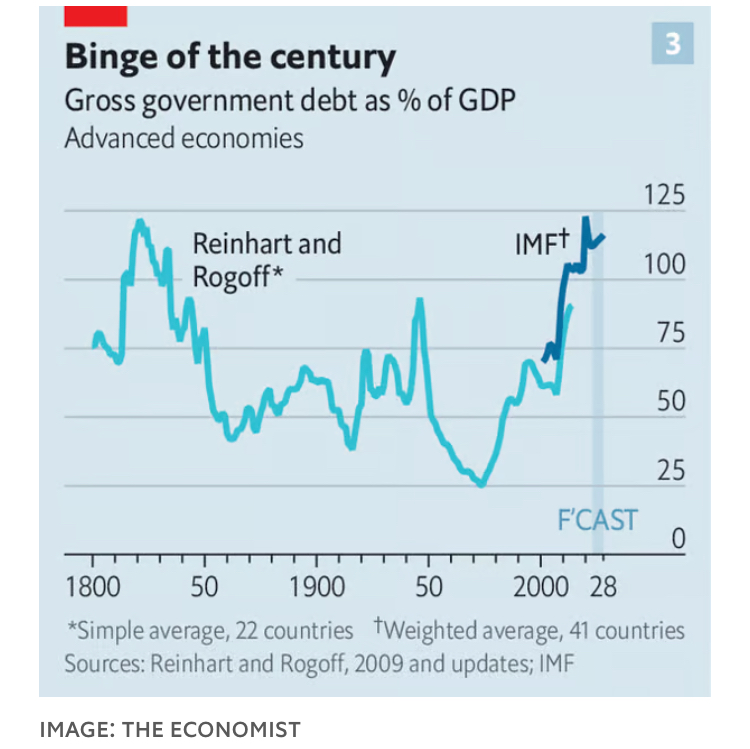

To the extent government debt is to blame for “higher-for-longer”, then the world economy will have to deal with higher rates without any accompanying fillip to growth. That would be painful.

Something’s got to give, whether it’s a more restrictive fiscal policy or some sort of debt crisis.

Other than a fiscal crisis, how could the tension be resolved? One possibility is that persistently high inflation could erode the real value of government debts.

Another possibility is that high rates push the world economy into a recession, which in turn causes central banks to cut them.

래리 서머스: 미국 정부부채와 고이자율

https://youtu.be/o-Yi3s9JduM?si=AveQOW5JXwDd3tk4